GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

On June 2, 2014, Law No. (22) for the year 2014 has been issued to impose a temporary three years additional tax amount-

ing to (5%) starting from the current taxable period. This additional tax is imposed on the tax pool over an amount of

One Million Egyptian pounds by individuals or corporates as stipulated in the articles of the Income tax Law. This ad-

ditional tax should be assessed and collected according to those articles. This law became into force starting from

June 5, 2014.

On June 30, 2014, Law No. (53) for the year 2014 has been issued by a presidential decree. This law included amendments for

some articles of Income Tax Law No. (91) for the year 2005. The most important amendments are as follows:

1. Imposing a tax on Dividends.

2. Imposing a tax on the capital gains resulted from sale of capital contribution shares and securities.

As the executive regulations related to the previously mentioned law has not been issued yet, that may result in inconsistency

in interpreting the articles of the law, the company’s management has assessed and quantified the impact of these amend-

ments is in the light of its explanations for applying the articles of the law, this assessment and quantification may differ upon

issuance of the executive regulations of this law.

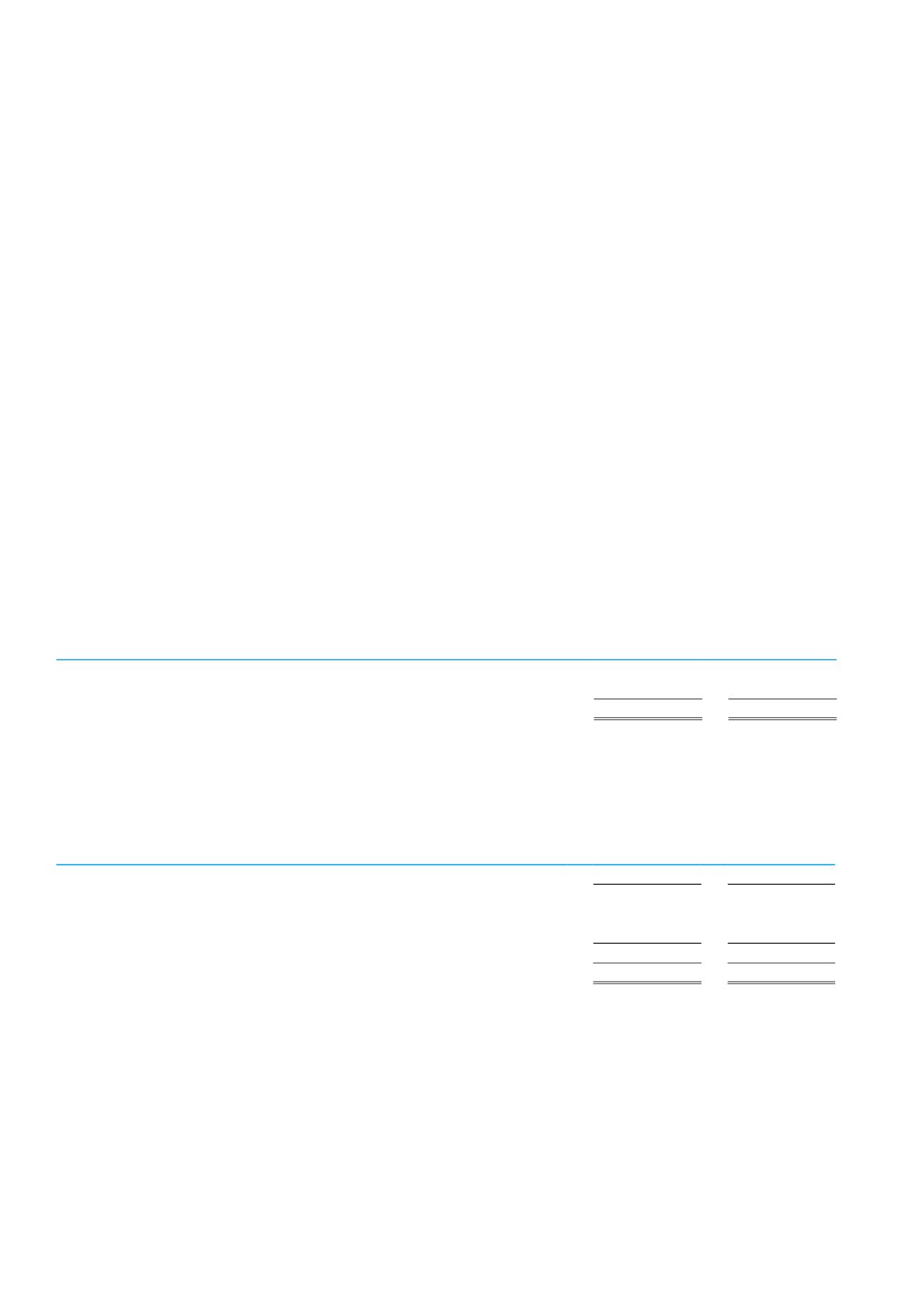

33. Earnings per share

(i) Basic

Since there is no suggested dividends account, accordingly the base used to calculate the net profit available for the share-

holders was determined based on the net profit for the year without deducting the employees share and the board of director

bonus.

Basic earnings per share is calculated by dividing net profit for the year by the weighted average number of ordinary shares

issued during the year.

2014

2013

Net profit attributable to shareholders

173 989

116 001

Weighted average number of ordinary shares issued

125 636

128 893

Basic earnings per share/ EGP

1.38

0.90

(ii) Diluted

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares for all the resulted ef-

fects for all dilutive potential ordinary shares.

2014

2013

Net profit attributable to shareholders

173 989

116 001

Weighted average number of ordinary shares

125 636

128 893

Restated

Stock option for the managing director

-

4 514

125 636

133 407

Diluted earnings per share/ EGP

1.38

0.87

Ghabbour Auto | 2014 ANNUAL REPORT

80