novative products across our portfolio

of financing ventures, catering to the

unique demands of our customers.

As a believer in the solid fundamentals

of the Egyptian automotive market, GB

Auto has valued long-termgrowthmore

than short-term gains. While we antici-

pate the float of the Egyptian pound is a

challenge our business and others will

be managing into 2018, we stand by the

majority of the Egyptian business com-

munity in welcoming the government’s

extensive basket of reforms, seeing

them as the future of the automotive

industry. We believe the finalization

of the Automotive Directive’s pro-local

industry policies are set to support both

local automotive players and national

economic development.

2017 is providing to be challenging. With

higher than usual inventory and debt

levels at the end of 1Q17, in addition to the

200 bps hike in interest rate inMay 2017,

just before the release of this Annual Re-

port, our strategyhas shiftedquite fast to

conduct an inventory and debt reduction

program that would see us return to a

leaner formby the end of the year

I would like to extendmy sincere grati-

tude for all your support throughout

both the challenging times behind us

and the road ahead. We are under no

false assumptions that the journey

forward will be without bumps in the

road, but stand rooted in our belief that

companies like GB Auto who weather

the storm now, will reap substantial

rewards as we roll out new products,

technologies, and partnerships that

will both boost customer satisfaction

and maximize value for shareholders.

Dr. Raouf Ghabbour, CEO

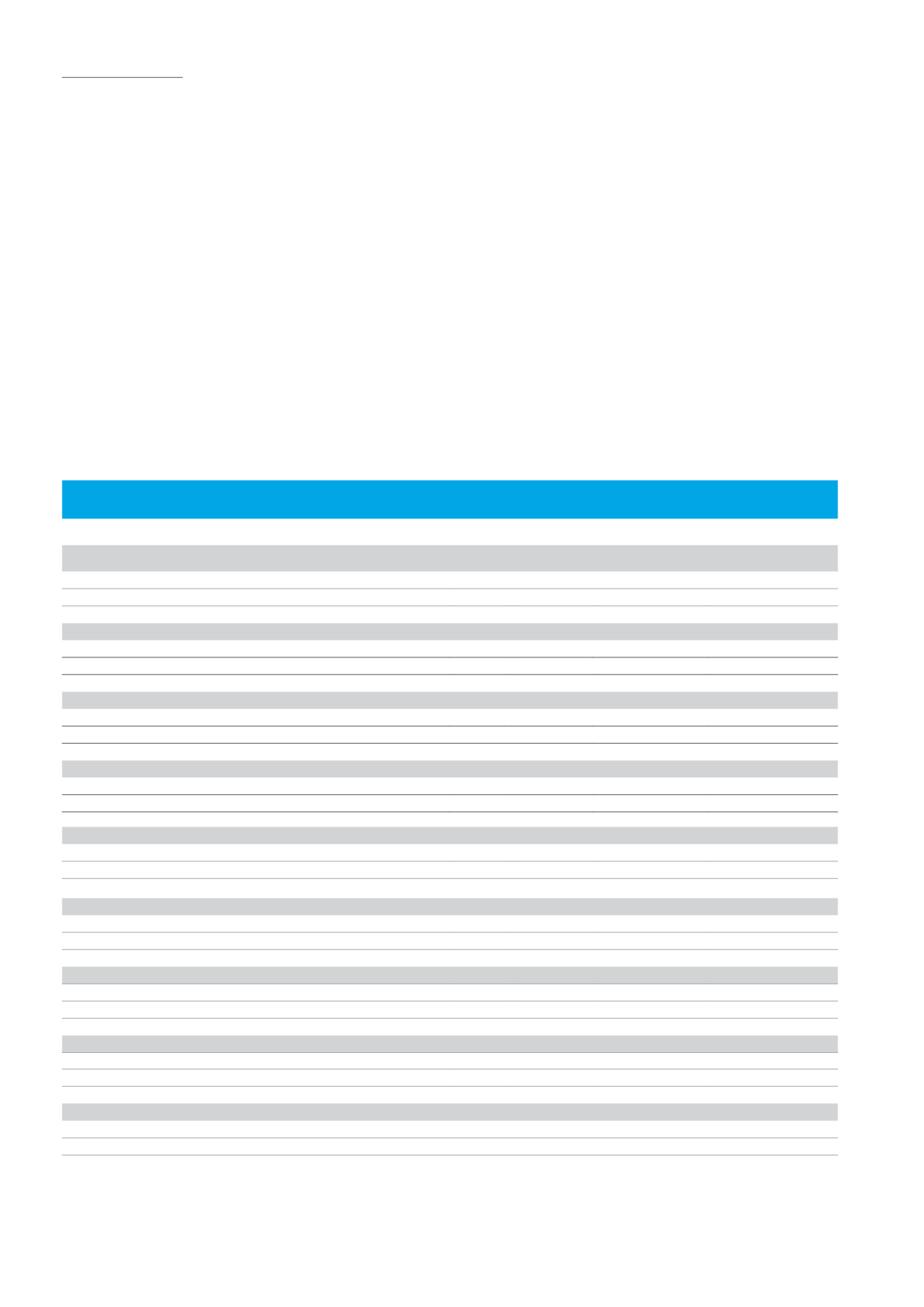

Summary Overview of Performance by Line of Business*

(LEmillion)

2016

2015

Change

Egypt PassengerCars

Revenue

8,016.1

5,713.1

40.3%

Total Gross Profit

942.3

647.9

45.4%

Gross Profit Margin

11.8

%

11.3

%

0.4

EgyptMotorcycles andThree-Wheelers

Revenue

1,708.2

1,892.5

-9.7%

Gross Profit

241.2

328.7

-26.6%

Gross Profit Margin

14.1

%

17.4

%

-3.3

Commercial Vehicles andConstructionEquipment

Revenue

1,113.3

1,216.9

-8.5%

Gross Profit

201.3

167.7

20.0%

Gross Profit Margin

18.1

%

13.8

%

4.3

Egypt Tires

Revenue

462.5

203.2

-

Gross Profit

101.3

27.5

-

Gross Profit Margin

21.9

%

13.6

%

8.4

FinancingBusinesses

Revenue

1,739.6

1,046.2

66.3%

Gross Profit

404.9

233.8

73.2%

Gross Profit Margin

23.3

%

22.3

%

1.0

Egypt After-Sales

Revenue

826.2

569.1

45.2%

Gross Profit

262.0

164.4

59.4%

Gross Profit Margin

31.7

%

28.9

%

2.8

Regional

Revenue

1,201.4

1,544.6

-22.2%

Gross Profit

19.6

25.0

-21.4%

Gross Profit Margin

1.6

%

1.6

%

-

Others

Revenue

218.5

79.0

-

Gross Profit

29.6

9.0

-

Gross Profit Margin

13.5

%

11.3

%

2.2

Group

Revenue

15,285.7

12,264.7

24.6%

Gross Profit

2,202.1

1,603.9

37.3%

Gross Profit Margin

14.4

%

13.1

%

1.3

* All figures provided above are net after elimination of inter-company accounts

2016 ANNUAL REPORT

4

Message From the CEO