GB Auto believes play a pivotal role in supporting funda-

mental and long-term growth in the market. We continue

to invest accordingly, despite a lack of short-term visibility

imposed by the nation’s current foreign currency situation

and procedural reforms.

Management has successfully closed an LE 960 million

capital increase to fund construction of two new facilities.

The first will be a wholly owned plant that will assemble mo-

torcycles and three-wheelers, whichmanagement believes to

be the first Bajaj plant outside of India. The second will be a

new tire-manufacturing facility to serve the MENA region’s

growing tires market. The two new facilities will expand GB

Auto’s opportunities in these fast-growing lines of business,

enhancing the group’s profitability and FX outlook in the

long term (via exports).

In addition to a continual focus on growth and investment in

long-term opportunities, management has also stressed ef-

ficiency. The company is accustomed to operating in a lean,

efficientmanner inall aspects of the business—a trait thatwill

serve us well as the country’s free trade agreements with the

EU and Turkey on import duties are fully implemented. These

agreements have already placed Chinese and South Korean

vehicles at a disadvantage, and management believes the full

implementationof the twopartnership agreements couldhave

a substantial negative impact on the market. The government

of Egypt appears to recognize the difficult position in which

automotive manufacturers and assemblers find themselves,

andmanagement continues to actively advocate for legislation

that protects domestic assemblers and the countless valuable

manufacturing jobs they support.

In the Passenger Car segment, management acknowledges

the downside risk to previous guidance arising from the

current national foreign-exchange crunch and a lack of

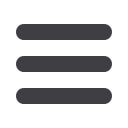

Group Revenues by Year

(LE million)

7,415.3

8,290.1

9,126.7

12,264.7

12,322.1

6,873.8

2010 2011 2012 2013

2015

2014

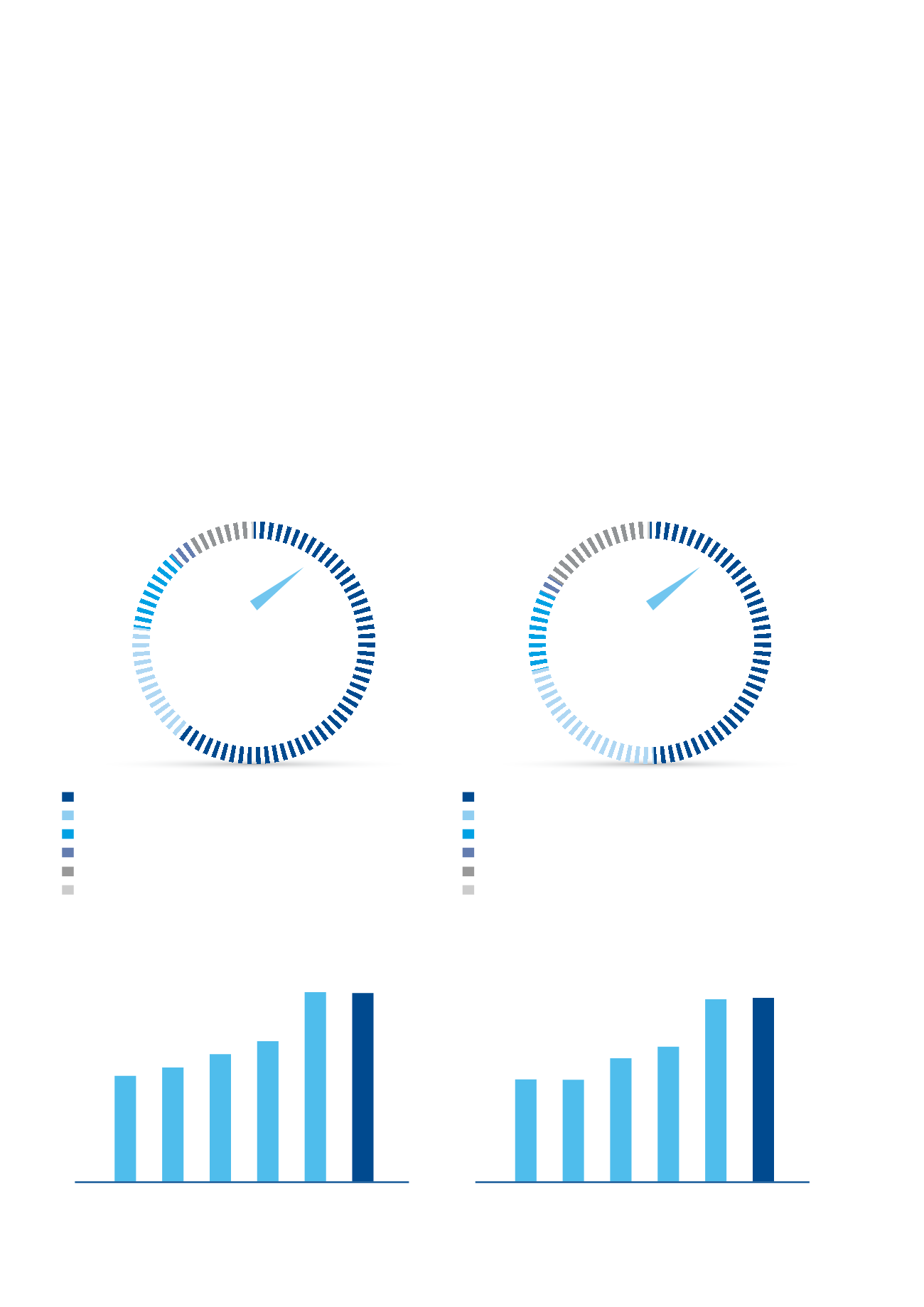

Group Gross Profit by Year

(LE million)

883.3

1,071.6

1,170.3

1,594.4

1,581.7

885.4

2010 2011 2012 2013

2015

2014

Passenger Cars

61.1%

Motorcycles and Three-Wheelers

16.3%

Commercial Vehicles and Construction Equipment 10.8%

Tires

2.6%

Financing Businesses

8.5%

Others

0.6%

Passenger Cars

49.7%

Motorcycles and Three-Wheelers

21.7%

Commercial Vehicles and Construction Equipment 11.0%

Tires

2.3%

Financing Businesses

14.7%

Others

0.6%

Revenue

Contribution by

LOB

Gross Profit

Contribution by

LOB

10 | GB Auto |

2015

Management Review and Financial Performance