Vehicles and Construction Equipment division, especially

within the bus segment. An attempted overhaul of the coun-

try’s public transportation system saw us deliver more than

400 buses to the Cairo and Alexandria Transport Authori-

ties – and sign tenders that should keep our pipelines busy

well into the second half of 2016.

Likewise, our Financing business was a top-performer in

2015, showing steady and promising growth. This year, and

to a great reception, we launched our fifth financing venture,

Tasaheel, which focuses primarily on direct microfinance

group lending to women.

Across our different business lines, the After-Sales division

postedpromising results, contributingpositively to thegroup’s

profitability. GB Auto’s retail arm is in the process of rolling-

out new after-sales retail outlets that will be called “360,” and

will distribute tires, tire parts, batteries, parts and lubricants.

These points of presence will also offer other services, such

as tire installation and the sale and injection of lubricants in

several locations, among other things.

As an investor in long-term growth, we have always looked

ahead andwe continue to do so

now.Wehave a steadfast belief

in the fundamental strengths of the Egyptian economy and

the eventual recovery of regional markets. As our approach in

2015 clearly reflects, we remain in pursuit of diversification,

on both

the product and geographic levels. Our margins

throughout all those difficulties remained strong, and as

we await the return of FX liquidity to our home market,

we will continue to use our pricing power, not only to

preserve margins, but to hedge our business against

unforeseen developments, while keeping all our costs

under tight control and ensuring that working capital

remains at healthy levels.

From a macroeconomic standpoint, it is our view that

the government of Egypt needs to send two clear and

strong signals to businesses and investors alike: that it

will be responsive to new economic realities and that it

will support primarily medium-weight and medium-

technology industries that will create jobs and grow ex-

ports. The Central Bank of Egypt’s c. 14%devaluation of

the LE against the USD in March 2016 is the first step in

the direction of aligning monetary policies with prevail-

ing economic realities. On the second front, I would like

here to reiterate the importance of an automotive direc-

tive as a pro-local industry policy to support national

economic development.

In closing, I would like to thank you all for your contin-

ued support. We are well aware of how fast things can

change in emerging markets, and we will continue to

hold a long-term view that supports our growth and al-

lows us to maintain profitability in adverse conditions.

Dr. Raouf Ghabbour, CEO

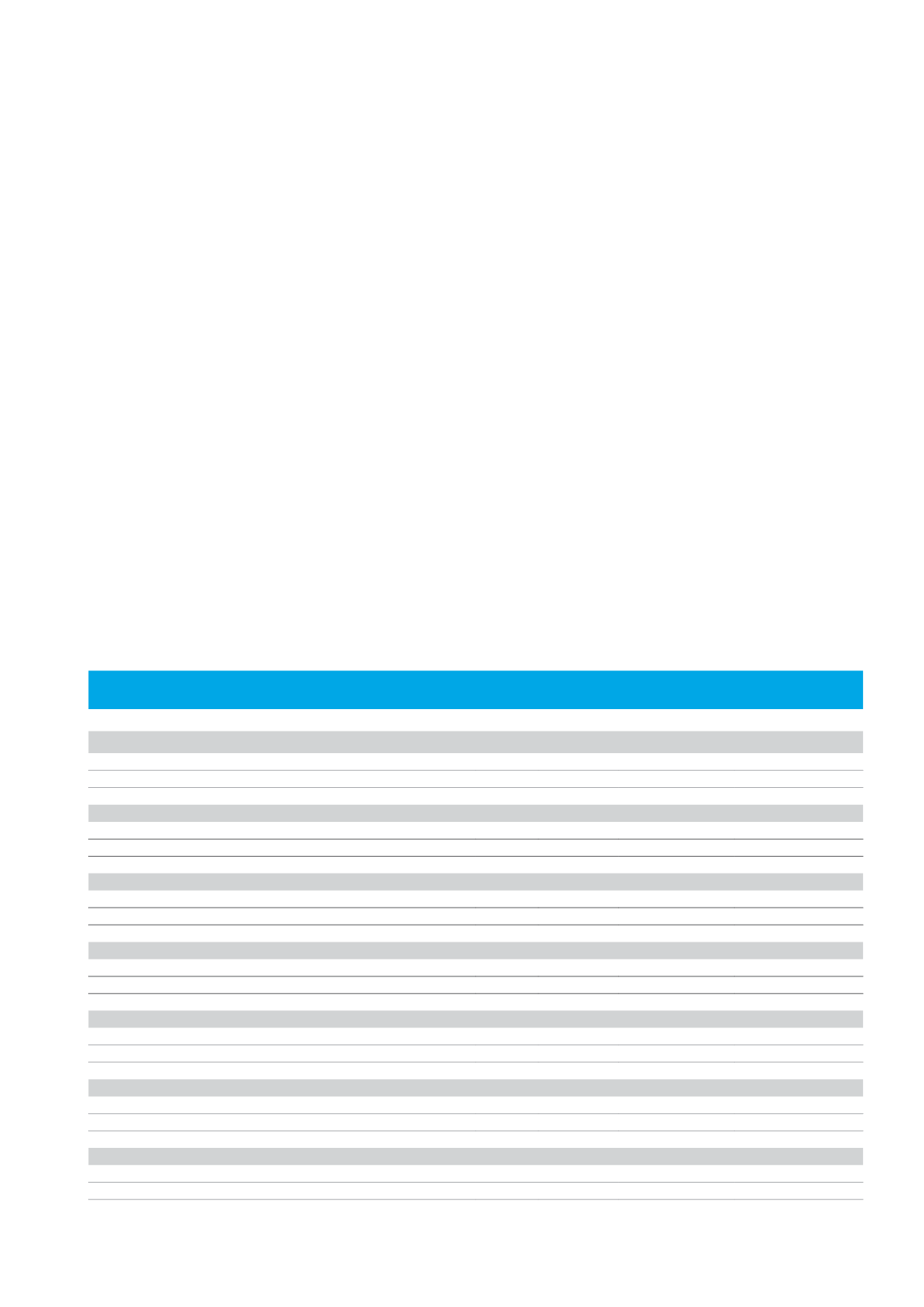

Summary Overview of Performance by Line of Business

(LE million)

2015

2014

%Change

Passenger Cars

Revenue

7,489.9

8,909.9

-15.9%

Total Gross Profit

793.0

1,010.8

-21.5%

Gross Profit Margin

%

10.6%

11.3%

-0.8

Motorcycles and Three-Wheelers

Revenue

1,997.2

1,334.0

49.7%

Gross Profit

346.7

245.6

41.2%

Gross Profit Margin

%

17.4%

18.4%

-1.0

Commercial Vehicles and Construction Equipment

Revenue

1,327.9

912.9

45.5%

Gross Profit

175.8

98.1

79.3%

Gross Profit Margin

%

13.2%

10.7%

2.5

Tires

Revenue

324.4

415.2

-21.9%

Gross Profit

36.0

63.7

-43.4%

Gross Profit Margin

%

11.1%

15.3%

-4.2

Financing Businesses

Revenue

1,046.2

722.7

44.8%

Gross Profit

233.8

168.8

38.5%

Gross Profit Margin

%

22.3%

23.4%

-1.0

Others

Revenue

75.9

24.1

-

Gross Profit

15.8

1.6

-

Gross Profit Margin

%

0.2

0.1

14.3

Group

Revenue

12,264.7

12,322.1

-0.5%

Gross Profit

1,594.4

1,581.7

0.8%

Gross Profit Margin

%

13.0%

12.8%

0.2

3 | GB Auto |

2015